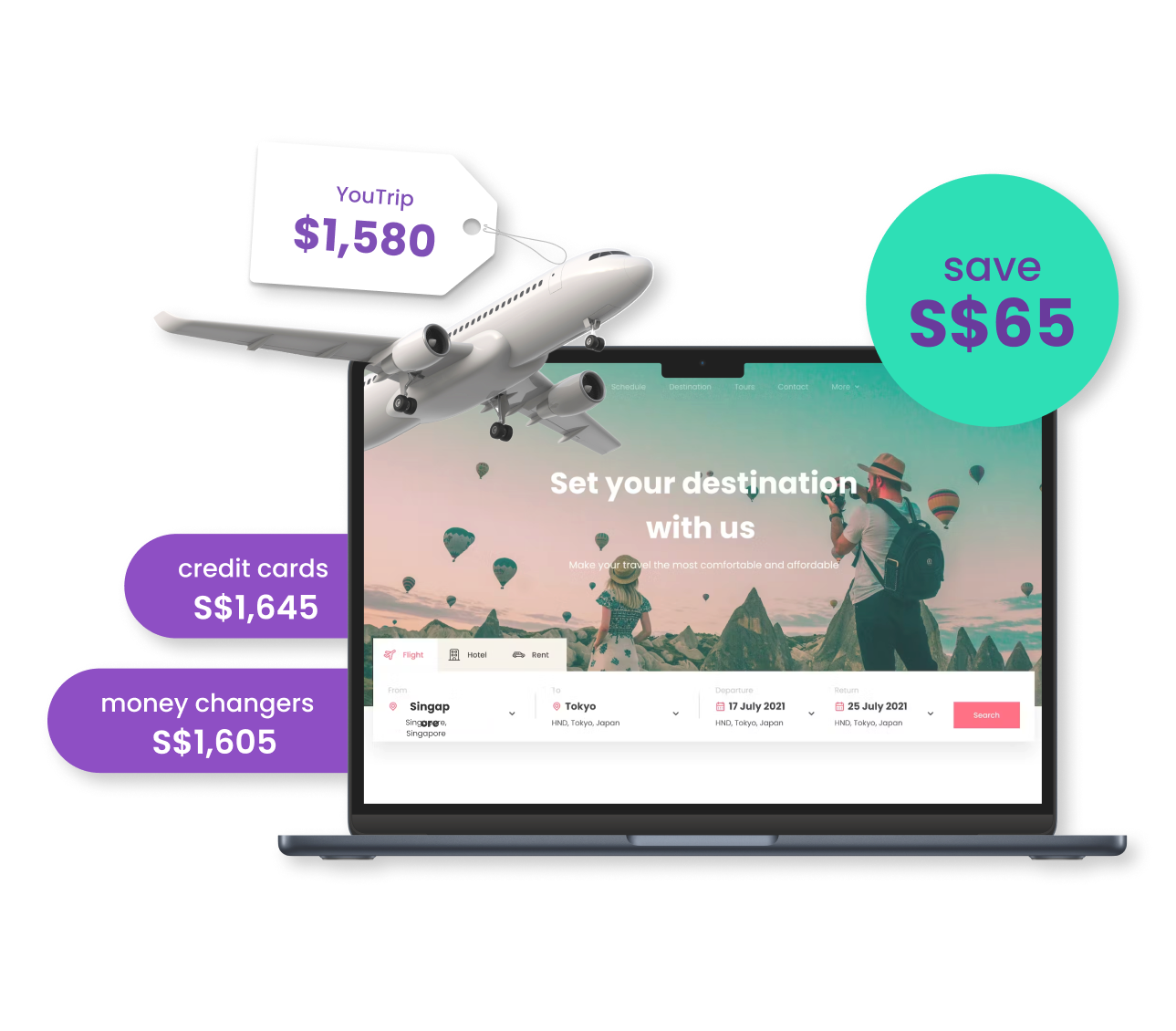

best rates, it’s our thing

Previous

Next

Source: Average exchange rate including transaction and additional fees.

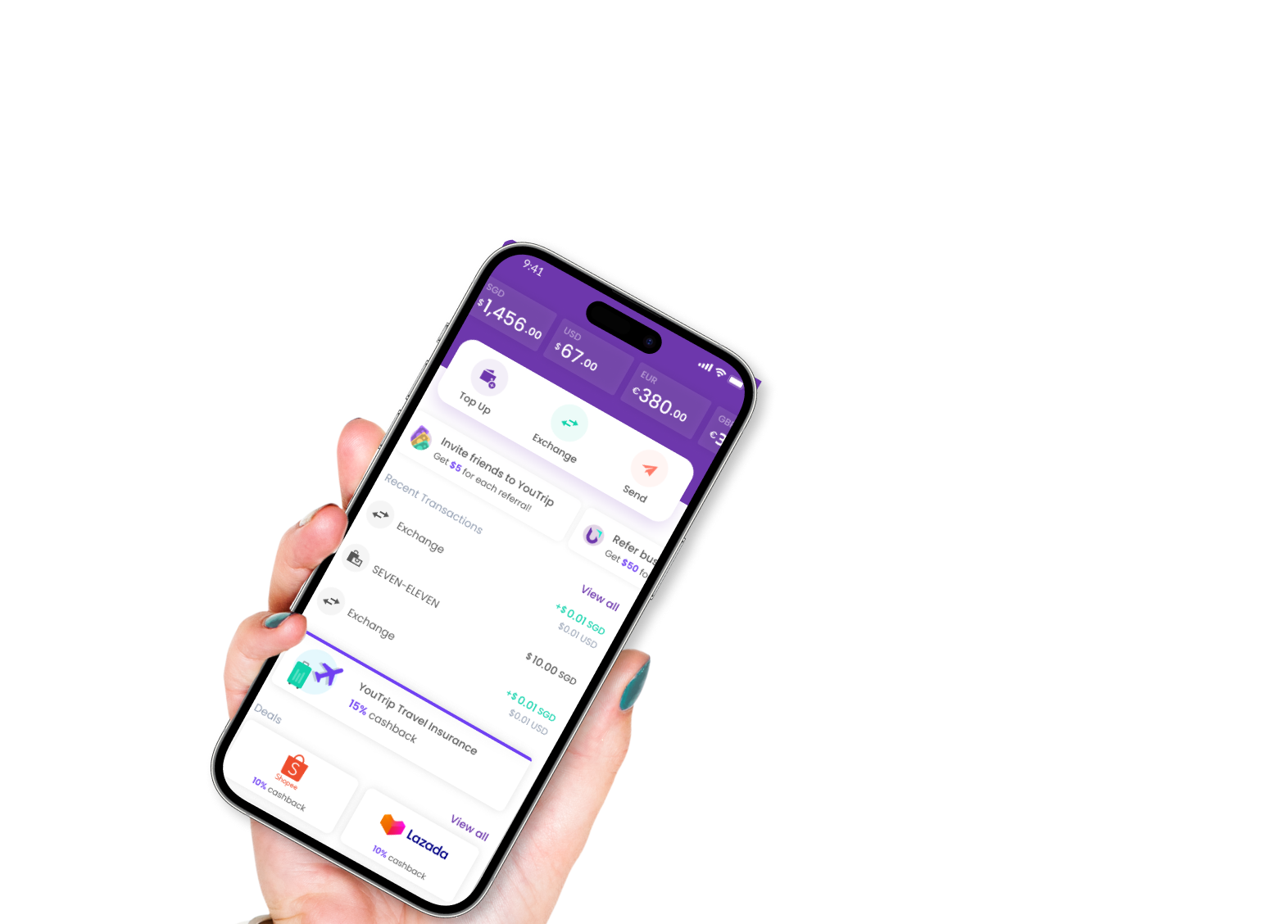

whenever wherever

we got you

Pay with the best rates in 150+ countries

and enjoy our in-app exchange with our

10 wallet currencies – all at your fingertips!

and enjoy our in-app exchange with our

10 wallet currencies – all at your fingertips!

goodbye

hidden fees

Don’t sweat the fees! Travel and shop freely with zero FX fees, no hidden charges and fee-less* ATM withdrawals.

*Enjoy zero ATM fees from 15 June onwards.

Applicable for the first S$400 in foreign currency per

calendar month. 2% fees apply thereafter. T&Cs apply.

Applicable for the first S$400 in foreign currency per

calendar month. 2% fees apply thereafter. T&Cs apply.

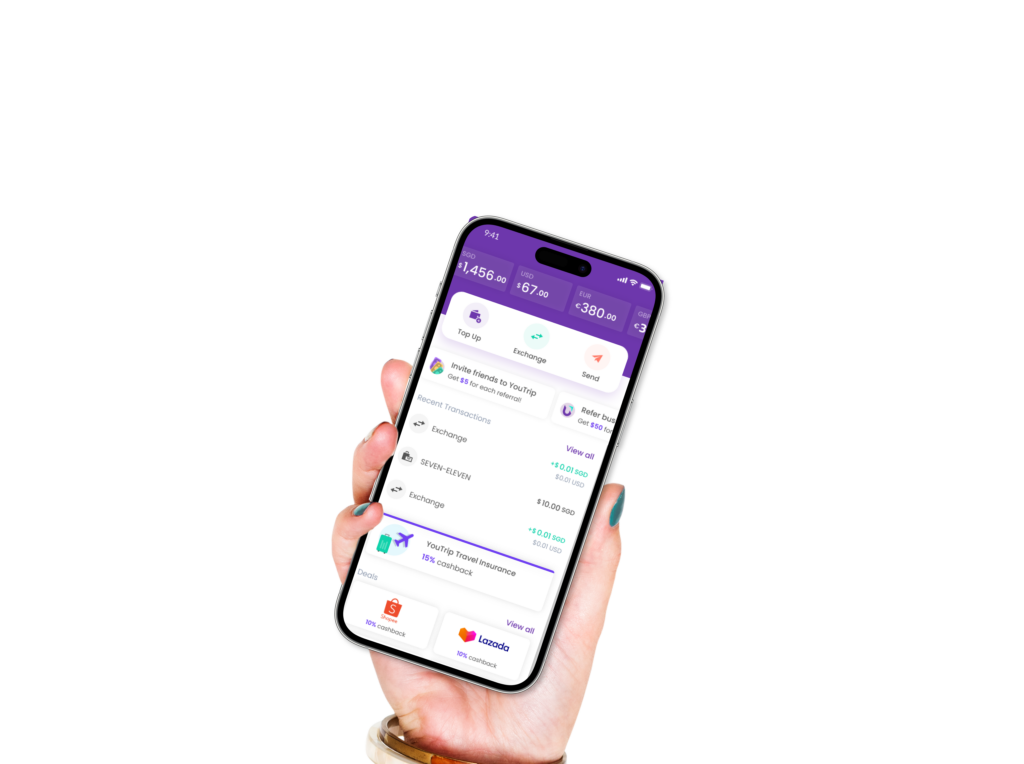

virtually yours

Get a level up in convenience with

seamless in-app and online payments

via your very own virtual card – in just

a few taps (or less!).

seamless in-app and online payments

via your very own virtual card – in just

a few taps (or less!).

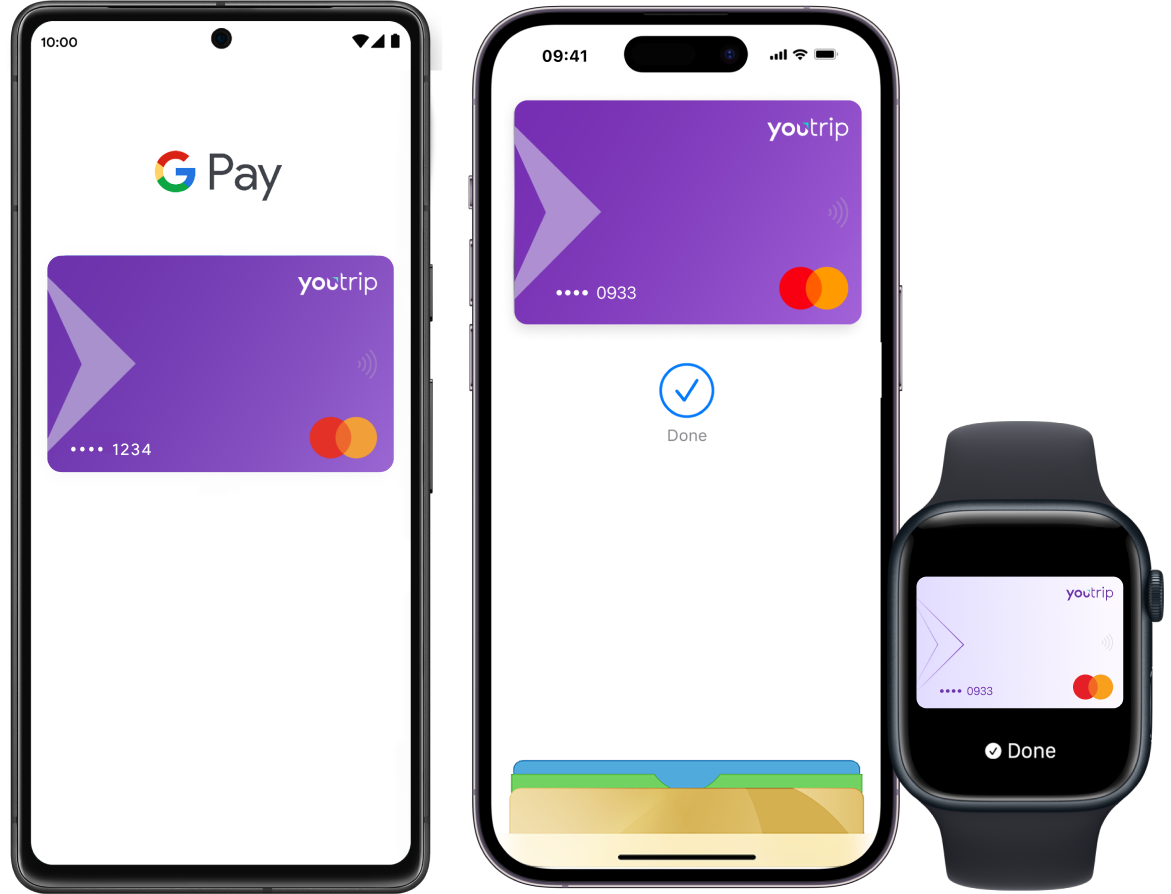

Apple Pay &

Google Pay™ on the go

Seamless payments, now upgraded with Apple Pay and Google Pay, be it online or in-store.

can’t get safer than this

one-click lock system

Lock and secure your card instantly with just one tap if you’ve misplaced it.

24/7 monitoring

Have the ease of mind while our committed fraud and security teams work hard to keep your money safe.

instant payment

Stay on top of your transactions with push notifications for each payment you make.

savings never

felt sweeter

Who says no to more cashback and offers?

Get more out of your YouTrip experience with great deals and savings on your favourite brands with YouTrip Perks!

you said it first

What’s it like to be on YouTrip?

Hear it directly from other happy

YouTroopers!

Hear it directly from other happy

YouTroopers!

0% transaction fee anywhere! It's really simple to use to the card and you just need to top up via the mobile app. Conversion rates are better than the money changers as well.

Tay Yu Xiang

Tay Yu Xiang

YouTrip is perfect for me. I travel a lot for work. With YouTrip, I carry a lot less cash with me. It's safer and more convenient. The FX rate is extremely competitive as well.

Justin

Justin

join us for free

in just 3 mins

download app

Available on iOS and Android.

register

Use MyInfo or submit your identity documents manually.

delivered

Get your hands on your

free YouTrip card.

free YouTrip card.

sign up to our newsletter

Stay up to date with the latest news, announcements and articles.

need help?

Get in contact with our customer

support at customer@you.co

best rates, it’s our thing

Retail Price: €894

Retail Price: ¥61,800

Retail Price: US$1,173

Source: Average exchange rate including transaction and additional fees.

whenever

wherever

we got you

Pay with the best rates in 150+ countries and enjoy our in-app exchange with our 10 wallet currencies – all at your fingertips!

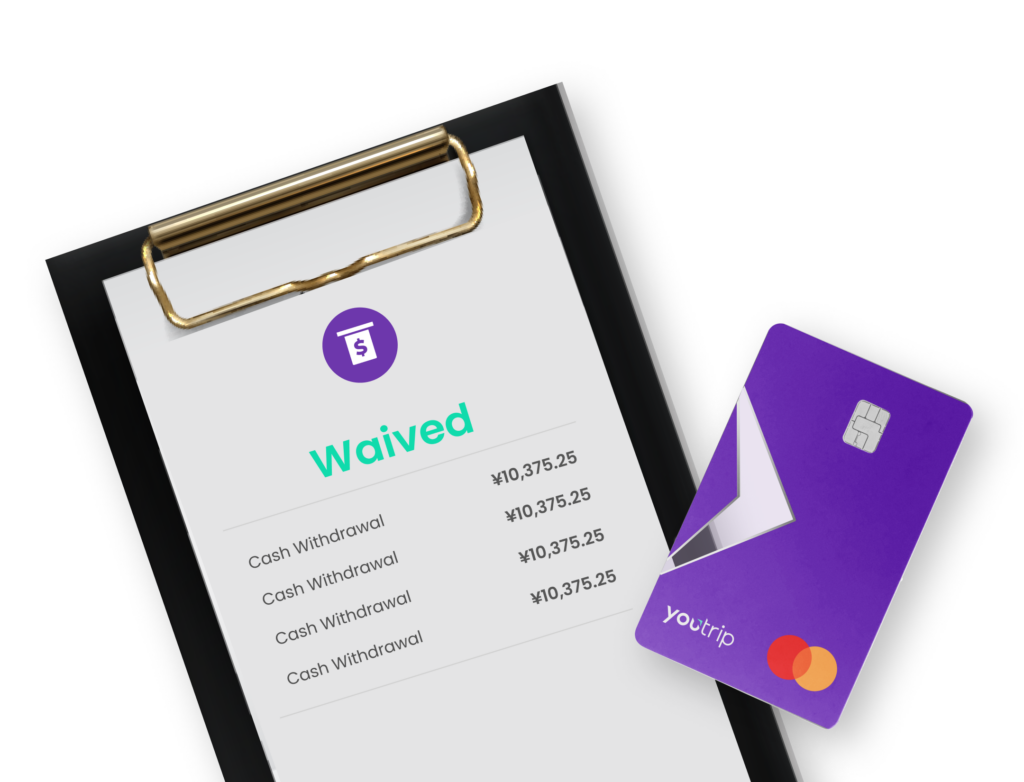

goodbye

hidden fees

Don’t sweat the fees! Travel and shop freely with zero FX fees, no hidden charges and fee-less* ATM withdrawals.

*Enjoy zero ATM fees from 15 June onwards.

Applicable for the first S$400 in foreign currency per calendar month.

2% fees apply thereafter. T&Cs apply.

Applicable for the first S$400 in foreign currency per calendar month.

2% fees apply thereafter. T&Cs apply.

virtually

yours

Get a level up in convenience with seamless in-app and online payments via your very own virtual card – in just a few taps (or less!).

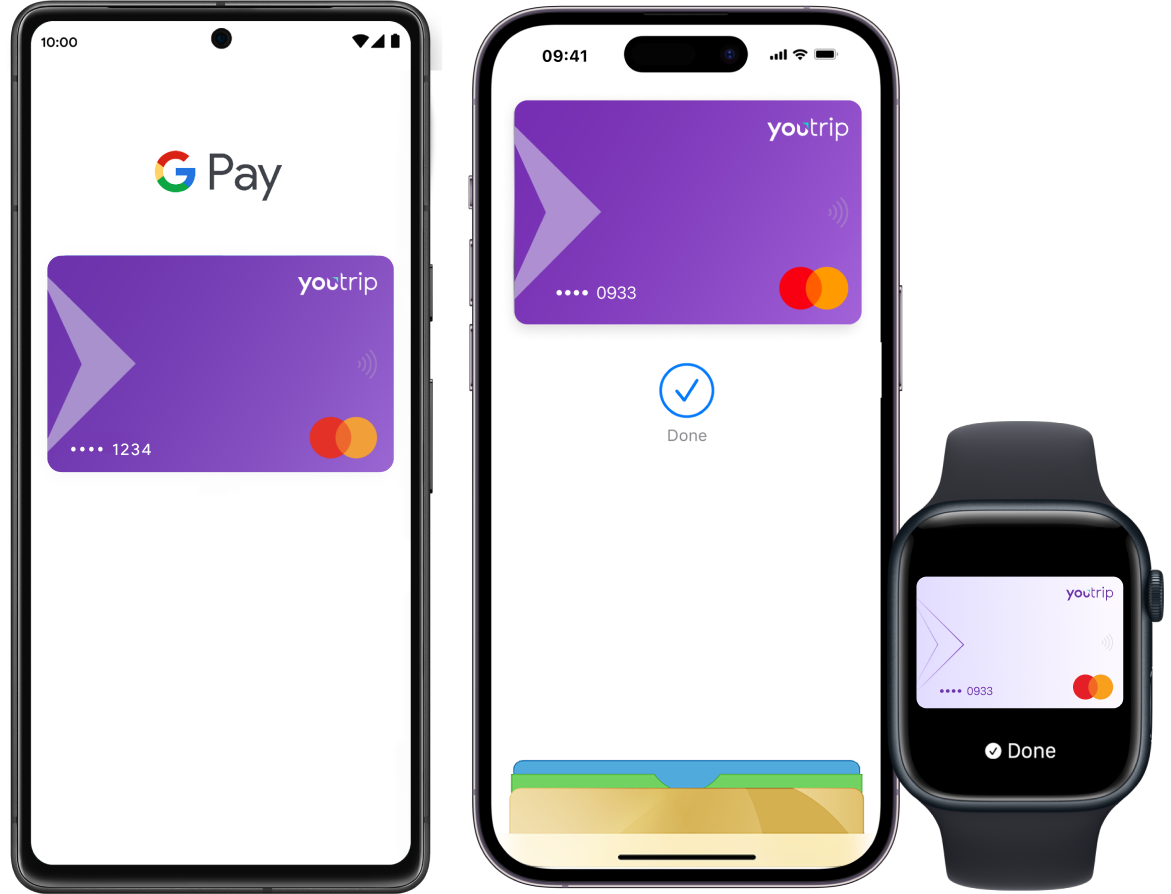

Apple Pay

& Google Pay™

on the go

Seamless payments, now upgraded with Apple Pay and Google Pay, be it online or in-store.

can’t get safer than this

one-click

lock system

lock system

Lock and secure your card instantly with just one tap if you’ve misplaced it.

24/7

monitoring

monitoring

Have the ease of mind while our committed fraud and security teams work hard to keep your money safe.

instant payment

alerts

alerts

Stay on top of your transactions with push notifications for each payment you make.

savings never

felt sweeter

Who says no to more cashback and offers?

Get more out of your YouTrip experience with great deals and savings on your favourite brands with YouTrip Perks!

Get more out of your YouTrip experience with great deals and savings on your favourite brands with YouTrip Perks!

you said it first

What’s it like to be on YouTrip?

Hear it directly from other happy YouTroopers!

0% transaction fee anywhere! It's really simple to use to the card and you just need to top up via the mobile app. Conversion rates are better than the money changers as well.

Tay Yu Xiang

YouTrip is perfect for me. I travel a lot for work. With YouTrip, I carry a lot less cash with me. It's safer and more convenient. The FX rate is extremely competitive as well.

Justin

Fees are transparent. The card with the best rates and very convenient to use overseas.. Application is simple to use and fuss free. Great card when you go to multiple countries. Great job youtrip team! 🙂

Steve

Easy & convenient to use! You can use it worldwide even though there’s 24/7 money exchange rate on the app. Overall the best ~

Rifiqi

I get to enjoy 0% transaction fees and competitive exchange rates when I use my YouTrip Mastercard. Highly recommended.

June Liew

Easy to use, convenient for on-the-spot exchanges. Great for foreign currency on your card. great rates as well.

Alex Lim

join us for free in just 3 mins

download app

Available on iOS

and Android.

and Android.

register

Use MyInfo or submit your

identity documents manually.

identity documents manually.

delivered

Get your hands on your

free YouTrip card.

free YouTrip card.

sign up to our newsletter

Stay up to date with the latest news, announcements and articles.